Why Modern Employers Rely on AI to Get Their CTC Right Every Time

Introduction

In the global hiring landscape, compensation decisions are more than just numbers on a page. For employers, founders, and HR teams, calculating the Cost to Company (CTC) involves juggling base salary, bonuses, statutory contributions, taxes, and allowances — all of which vary widely across countries, currencies, and employment laws.

The stakes are high: errors can delay offers, confuse candidates, and even create legal liabilities. Yet, despite the availability of spreadsheets and legacy payroll software, mistakes are common. A 2023 global HR survey revealed that 32% of companies reported at least one payroll error per month, costing time, money, and employee trust.

This is why modern employers increasingly rely on AI-powered tools for CTC calculations. AI not only ensures accuracy but also introduces consistency, speed, and global scalability — allowing HR teams to focus on strategy rather than arithmetic.

The Complexity of CTC in a Global Context

CTC is rarely straightforward. Beyond base salary, it typically includes:

- Bonuses & Incentives: Performance-linked pay, retention bonuses, or project incentives.

- Statutory Contributions: Vary by country — provident fund in India, social security in the US, pension schemes in Europe.

- Allowances & Benefits: Housing, transport, healthcare, and wellness perks differ widely by region.

- Taxes & Deductions: Income tax rates, professional taxes, and other mandatory deductions fluctuate based on jurisdiction.

Consider a mid-level role offered in three countries:

- Mumbai, India: ₹12,00,000 CTC → Take-home ≈ ₹8,80,000

- Berlin, Germany: €60,000 CTC → Take-home ≈ €42,000

- Singapore: S$75,000 CTC → Take-home ≈ S$55,000

Each calculation must factor in local laws, statutory contributions, bonuses, and tax regimes. Manually ensuring precision across multiple currencies and countries is not just time-consuming — it’s error-prone.

Human Limitations vs. AI Capability

Even seasoned HR professionals face cognitive limitations when juggling these variables. It’s easy to overlook subtle differences, such as:

- How a mid-year bonus affects tax brackets in Germany.

- The interplay between employer contributions and take-home pay in India.

- How leave encashment or allowances influence payroll compliance in Singapore.

AI excels where human calculation struggles. By analyzing multiple variables simultaneously, AI ensures every component aligns with local laws and company policy. Instead of spending hours cross-referencing tables or recalculating for errors, HR teams can trust that every CTC breakdown is accurate and compliant.

Scenario Matrix: Manual vs. AI Calculations

|

Role |

Country |

Currency |

Base Salary |

Bonus |

Statutory Contributions |

Taxes & Deductions |

Take-Home |

Notes |

|

Software Engineer |

India |

₹ |

8,40,000 |

1,20,000 |

60,000 |

1,20,000 |

8,40,000 |

Manual errors common in deductions |

|

Software Engineer |

Germany |

€ |

50,000 |

6,000 |

4,000 |

14,000 |

42,000 |

Manual conversions prone to mistakes |

|

Software Engineer |

Singapore |

S$ |

55,000 |

5,000 |

5,000 |

20,000 |

55,000 |

Manual tracking of allowances complex |

In AI-powered calculations, all figures update dynamically. Adjust a bonus, a statutory rate, or a currency conversion, and the take-home recalculates automatically. This ensures instant accuracy across multiple geographies, eliminating the inconsistencies of manual methods.

Strategic Advantages Beyond Accuracy

Modern employers benefit from AI-driven CTC calculations in ways that go beyond precision:

- Faster Decision-Making: Offers can be finalized quickly, reducing candidate wait times.

- Global Consistency: CTC packages maintain fairness across locations and departments.

- Transparent Communication: Candidates receive clear breakdowns, fostering trust and confidence.

- Scenario Planning: HR can model multiple compensation structures to predict budget impacts.

- Strategic HR Focus: Freed from manual number-crunching, HR teams can focus on talent development and retention strategies.

Imagine an HR manager preparing offers for a global team. Instead of spending days adjusting spreadsheets for local taxes, bonuses, and allowances, AI generates accurate CTC breakdowns in seconds — in ₹, €, S$, or any currency. The manager can then focus on ensuring competitive and equitable offers, rather than worrying about arithmetic errors.

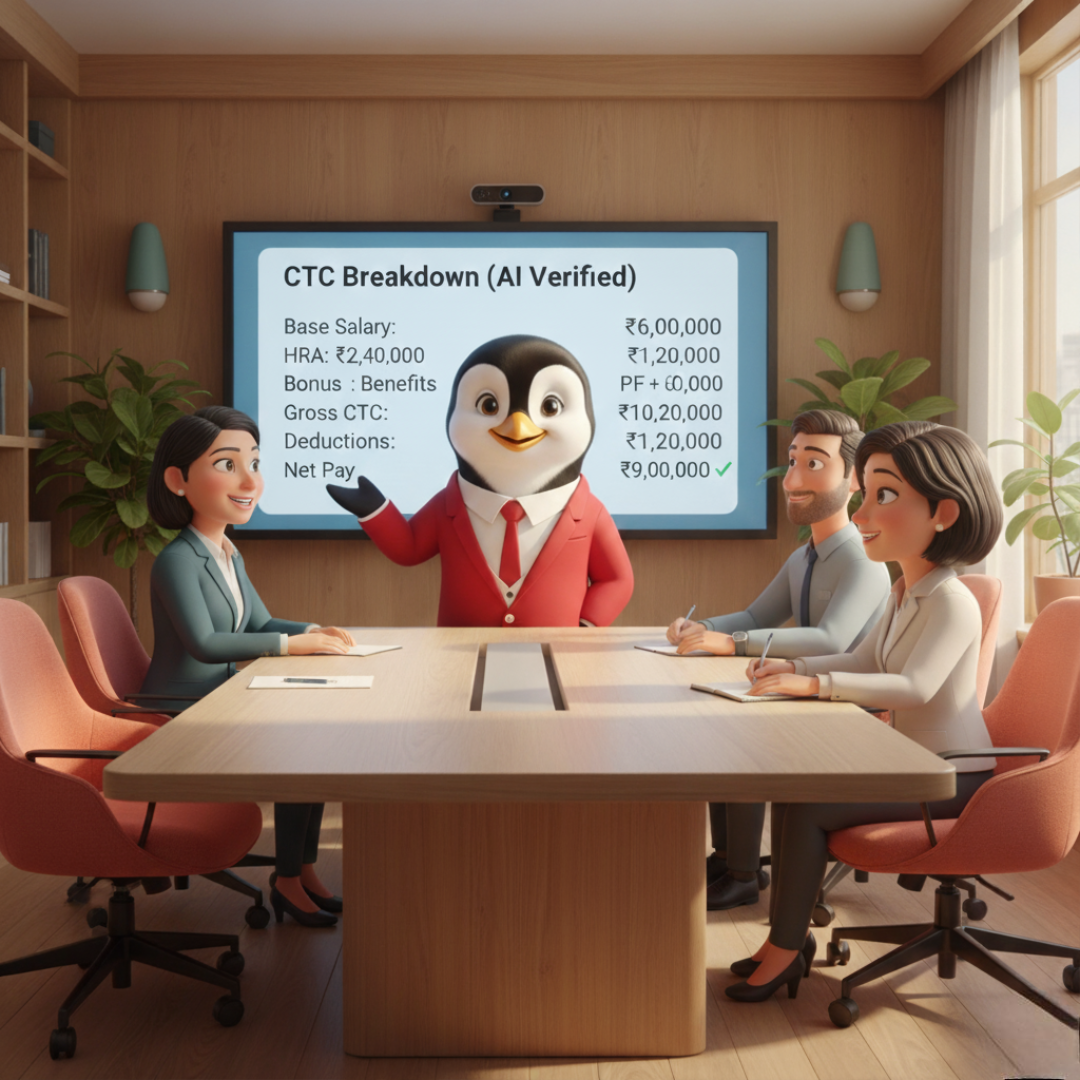

Real-World Application: Multi-Country Hiring

Take the example of a startup scaling across Asia and Europe. The HR team must onboard developers in India, project managers in Germany, and designers in Singapore. Each role requires a CTC breakdown tailored to local laws and regulations.

With AI:

- India: Calculates PF contributions, professional tax, and take-home.

- Germany: Accounts for social security, health insurance, and income tax.

- Singapore: Includes CPF contributions, allowances, and statutory benefits.

The result? Every employee receives a transparent, consistent, and accurate salary breakdown. Offers go out faster, acceptance rates improve, and the company avoids costly payroll errors.

Practical Recommendations for Employers

- Ensure Complete Inputs: Provide base salary, location, allowances, bonuses, and statutory obligations.

- Leverage AI for Scenario Testing: Adjust bonuses or allowances to see real-time impact on CTC.

- Communicate Transparently: Share AI-generated breakdowns with employees to minimize confusion.

- Update Regularly: Make sure AI tools reflect local changes in tax laws and regulations.

- Focus on Strategy: Use time saved to improve retention, performance incentives, and global HR planning.

Conclusion

In an era where global hiring and complex compensation packages are the norm, relying solely on manual calculations is no longer practical. Accuracy, transparency, and speed are essential for maintaining candidate trust, compliance, and internal consistency.

AI-powered Employer CTC Calculators provide a reliable, scalable, and globally applicable solution. They not only eliminate human error but also empower HR teams and founders to make strategic, data-driven decisions.

For organizations seeking to simplify compensation planning while ensuring precision across currencies and countries, HRTailor.AI’s Employer CTC Calculator offers an efficient, accurate, and user-friendly solution — letting teams focus on strategy, not spreadsheets.

Frequently Asked Questions

It’s an AI-powered tool that breaks down the total cost to company into base salary, allowances, bonuses, statutory contributions, taxes, and take-home pay.

Yes, it converts and calculates salaries in any currency while factoring in local tax rates, contributions, and allowances.

No, AI-powered calculators are user-friendly and require only basic inputs such as salary, bonuses, allowances, and location.

What Makes an Employee Evaluation Process Fair and Effective

Introduction Employee evaluations shape more than performance outcomes. They influence...

Read MoreHow Performance Reviews Help Employees and Managers Stay Aligned

Introduction Performance challenges rarely come from a lack of effort....

Read MoreJob Description Format Examples That HR Teams Actually Use

Job Description Format Examples That HR Teams Actually Use Introduction ...

Read MoreWhat Interview Questions Actually Help Hiring Teams Make Better Decision

What Interview Questions Actually Help Hiring Teams Make Better Decision...

Read More